How much should you pay yourself?

October 5, 2023

Being the boss means you get to make all the big decisions about your business – including how much to pay yourself in wages, salary or drawings.As the owner, you might need to underpay yourself in the early stages of building your business, so you can reinvest the profits...

COVID-19 Traffic Lights and Businesses

November 25, 2021

The new traffic light system will take some adjusting to, this comes into play at 11:59 pm on 2 December.

The following links to an article by the Local Chamber of Commerce, which sets out the requirements for businesses depending on the Vaccination status of Customers and ...

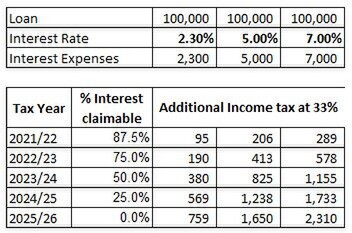

Background

Currently when owners of residential investment property calculate their taxable income they can deduct the interest on loans that relate to the income from those properties (claimed as an expense). This reduces the tax they need to pay....

Risk Management - What's your Plan?

October 26, 2023

Risk Management - What's your Plan?

Risk Management – what’s your plan? How do you manage risk in your business? You can’t expect the unexpected, but you might be able to put plans in place to limit risk and strengthen resilience. As a business owner, you are constantly assessing and managing risk, balan...

Should you buy a building for your business?

October 10, 2023

Tired of paying rent for your commercial premises and considering buying a premises for your business?Owning a building works best if your business is well-established, you have money to invest, and you’re taking a long-term approach – it can take many years for this dec...

COVID-19 Wage Subsidy March 2021

March 15, 2021

Who can apply

New Zealand businesses who have had or expect to have a 40% decline in revenue over a consecutive 14-day period between 28 February and 21 March, compared to a typical 14-day period between 4 January and 14 February 2021 (6 weeks before the change in alert levels), may be ab...

COVID-19 Wage Subsidy

March 11, 2021

Who can apply

New Zealand businesses who have had or expect to have a 40% decline in revenue over a consecutive 14-day period between 28 February and 21 March, compared to a typical 14-day period between 4 January and 14 February 2021 (6 weeks before the change in alert levels), may be ab...

Second COVID-19 Resurgence Support Payment (RSP)

March 11, 2021

Calculate if you are eligible.

The COVID-19 Resurgence Support Payment (RSP) is now available for business that experienced a 30% reduction in income from the 28th February 2021 to the 6th March 2021.

A business or organisation must have experienced at least a 30% drop in revenue or a 30% decline in ...

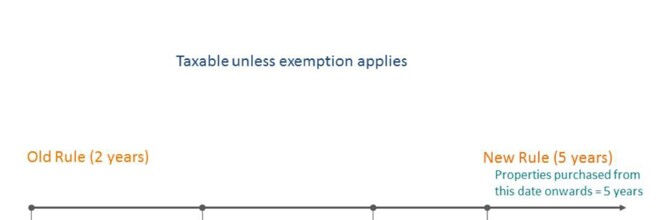

Bright-Line IR833 Form

November 18, 2020

Overview

The Bright-Line test applies if you brought and sold a property within 2 years. Any gain less any expenses is taxable and adds to your taxable income in that year.When your annual tax return is completed, you are required to file a IR833 form, gains will be ta...

Small Business Cashflow Loans - Changes Announced Nov20

November 13, 2020

IN BRIEF

The Government announces a three-year extension of the application time for the Small Business Cashflow Loan Scheme, and a doubling of the interest free period.Applications for the scheme were due to close at the end of 2020.Other changes include repayment provision...

Loading...

TAGS

COVID-19 SupportCOVID-19IRD SupportRental PropertySBCS loanBright-lineBrightlineCharitiesCOVID-19 Resurgence Support PaymentCOVID-19 Traffic LightsCOVID-19 Wage Subsidy ExtenstionCOVID-19 Wage Subsidy March 2021ElectricityFinancial SupportInterest DeductibilityIR833IRD LoansLoss Carry Back SchemeRing-fencing rulesTax ChangesTraffic LightsVaccination CertificatesVax CertificatesWage Subsidy

Loading...